Navigating Down Payment Assistance Programs: A Homebuyer’s Guide

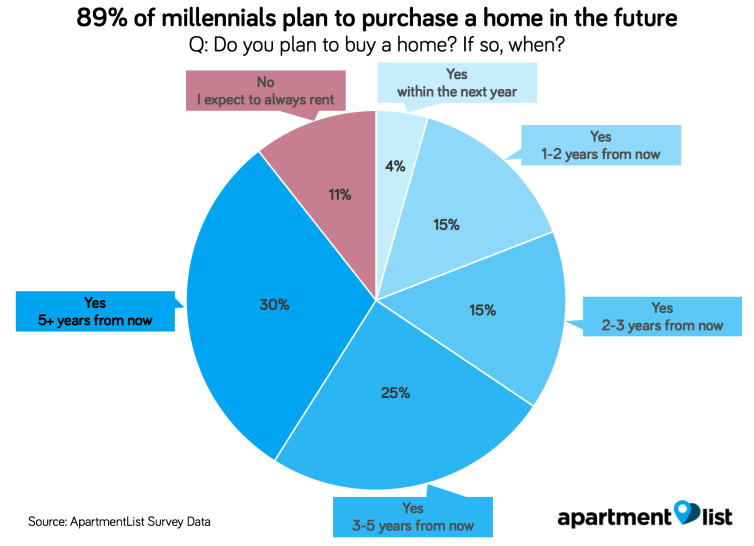

It turns out a lot of millennials want to buy a home someday — a whooping 89 percent according to a new Apartment List survey. But, just 5 percent expect to buy in 2019 and 34 percent say they will wait at least five years. Why the lag?

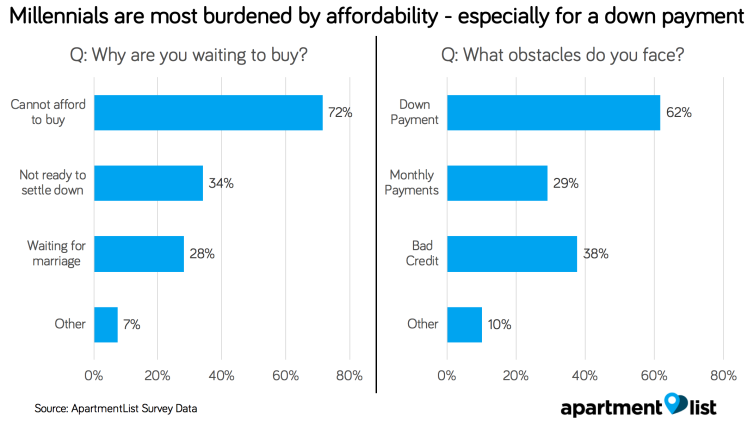

While the dream of homeownership is strong, 72 percent cite affordability as the critical issue.

Sixty-two percent of millennials specifically mention the lack of funds for a down payment. Only 11 percent have saved $10,000 or more for a home and 48 percent have zero down payment savings.

The survey also found that two-thirds of Millennial renters would require at least two decades to save enough for a 20 percent down payment on a median-priced condo in their market.

What this study overlooks is that a 20 percent down payment isn’t required and isn’t even typical for a first-time homebuyer. The average down payment for a first-time buyer is about 7 percent today, according to the National Association of REALTORS. So, don’t despair — you have options.

Today, there are multiple loan programs are available with as little as 3 or 3.5 percent required as a down payment. Some loan programs such as the VA loan program and the USDA Rural Development loans require zero down payment. Plus, there are more than 2,500 homeownership programs across the country that provide assistance with down payment and closing cost funds — you can check your eligibility on our online program search.

It might depend on how you prepare. We outlined four simple steps you can take to jump start your goal. Do your research and consider all your down payment options. You don’t have to sit out of the market for decades.

Happy goal setting!

Never want to miss a post? For more useful down payment and home buying information, be sure to subscribe to our mailing list.