How DPA Supports National Homeownership Month

Down Payment Resource’s Q4 2022 HPI report shows how homebuyer and down payment assistance flourished despite housing market downturns

Each quarter, we issue a Homeownership Program Index (HPI) report that examines data from our DOWN PAYMENT RESOURCE® database to uncover noteworthy changes and trends in U.S. homebuyer assistance programs.

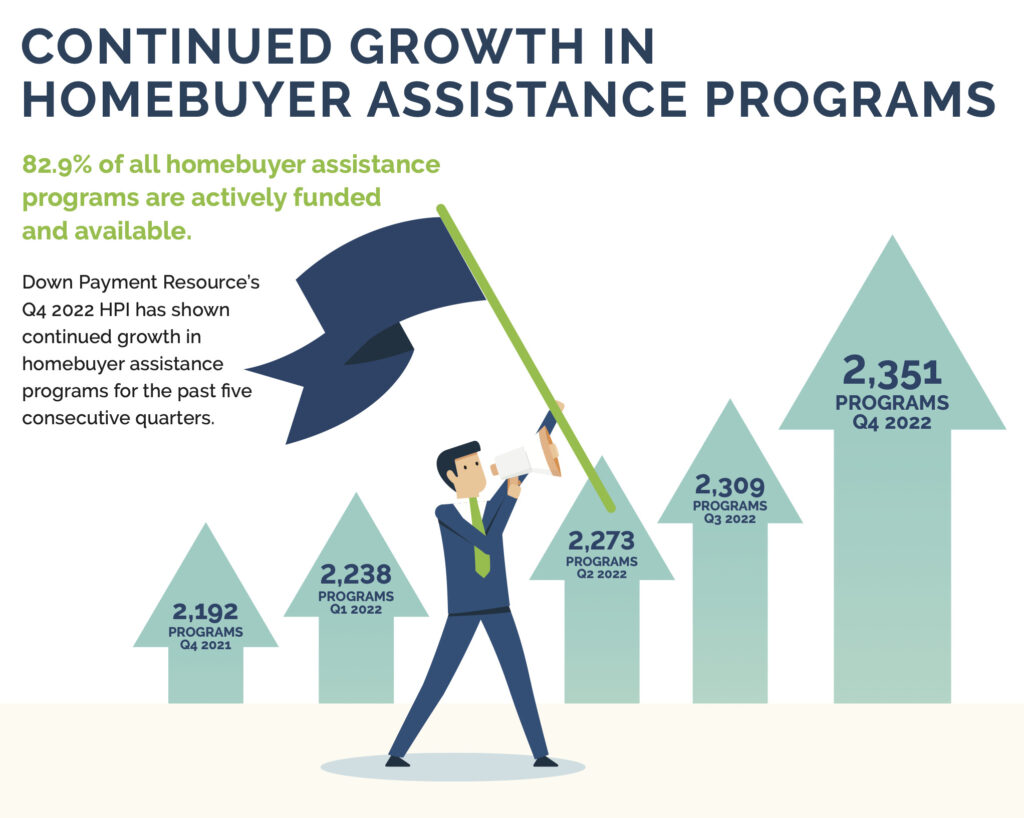

Our Q4 2022 HPI report revealed a 1.8% uptick in the number of homebuyer assistance programs available to help people finance homes, raising the number of programs to 2,351, a net increase of 42 over the previous quarter. Of these programs, 82.9% had funds available for eligible homebuyers as of January 6, 2022.

Here is a breakdown of the homebuyer assistance programs added last quarter:

The Vermont Champlain Housing Trust’s Manufactured Housing Down Payment (MHDP) Loan Program provides applicants with a deferred, zero-interest loan to help cover down payment and closing costs associated with the purchase of an Energy Star Rated manufactured home. MHDP loans are offered at 0% interest, and all payments are deferred until the property is sold, transferred, or refinanced. Participants must take an approved homebuyer education course to qualify for assistance.

The North Carolina Housing Coalition (NCHC) Homeownership Assistance Program (HAP) is a down payment and closing cost assistance program for low-to-moderate income (LMI) households that earn up to 120% of the area median income (AMI). The property must be a one or two unit primary residence located in one of the 16 counties defined by HUD as most impacted by Hurricanes Matthew and Florence. First-generation homebuyers whose parents do not currently own a home are eligible for up to $30,000 in down payment assistance and first-time homebuyers are eligible for up to $20,000. An additional 5% is provided toward closing costs.

The Family Housing Fund is a community collaborative that provides affordable Building Equity construction loans to support the development and rehabilitation of two-to-four unit multifamily homes homes in the Minneapolis and Twin Cities metro regions of Minnesota. The program prioritizes Black, Indigenous and People of Color building developers and homebuyers with low-to-moderate incomes. It also offers forgivable down payment assistance for qualifying homebuyers who have completed owner-occupant training.

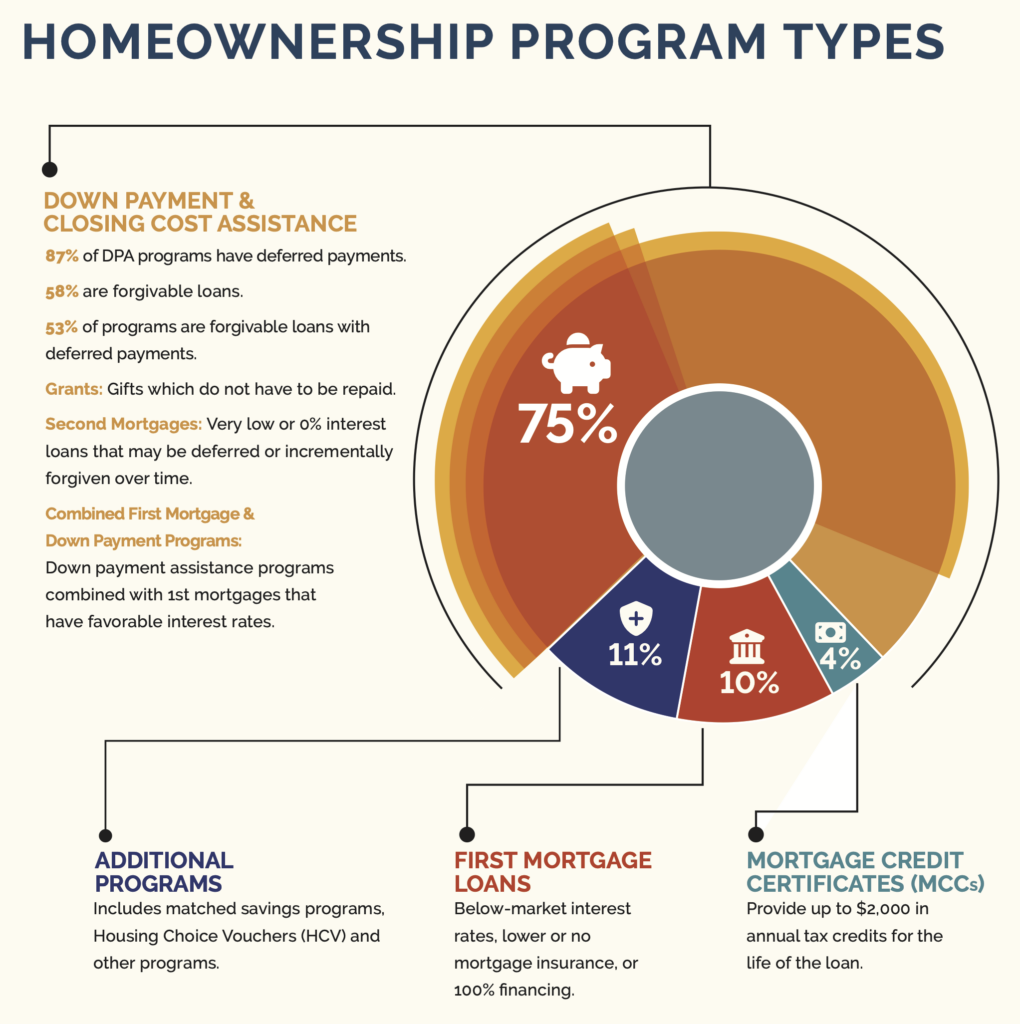

Overall, the breakdown of homebuyer assistance programs available by type was unchanged from the previous quarter.

Several new incentivized homebuyer assistance programs were added in Q4 2022, including four programs for veterans and military service members, four for firefighters, three for educators and three for protectors. Programs for Native American homebuyers and surviving spouses were also added.

A complete, state-by-state list of homebuyer assistance programs can be viewed here. Homebuyer assistance programs that waive the first-time homebuyer requirement for veterans and military personnel are tracked as two separate programs to report on dedicated assistance for military buyers.

You can also download the full infographic.

The number of U.S. homebuyer and down payment assistance programs grew steadily over each quarter of 2022, with 2,351 total programs now available. While there was a notable increase in the number of temporarily suspended programs in Q4 2022, these programs only make up 4.2% of all programs. With 83% of programs still being actively funded, homebuyer assistance remains a widely available option for homebuyers today. Mortgage and real estate professionals that want to boost revenue in this sluggish housing market can market programs like these to make homeownership more accessible and affordable to hesitant buyers in 2023.

Down Payment Resource has crafted tools to help mortgage lenders, real estate agents and multiple listing services build relationships with homebuyers by connecting them with the homebuyer assistance they desire.

To explore the best option for your business, contact us.