How DPA Supports National Homeownership Month

Atlanta-based Down Payment Resource, the nationwide databank for homebuyer assistance programs, today released its Second Quarter 2016 Homeownership Program Index (HPI). There are now 2,477 homeownership programs available and 85 percent currently have funds available for eligible homebuyers, up one percent from the previous quarter. The average down payment program benefit across all programs is $8,260.

“These programs are now the last frontier to address homeownership affordability. Rates are never going to be substantially lower, and home prices continue to trend higher,” said Rob Chrane, CEO of Down Payment Resource. “Homeownership programs can help buyers overcome the critical cost of entry.”

Specific incentives are available for community heroes across 14 percent of homeownership programs. These programs include special benefits for veterans, educators, protectors, firefighters, healthcare workers and disabled homebuyers. Approximately 5 percent of programs are for veterans or members of the military.

There are 23 programs available nationwide and 23 percent of the programs are available state-wide. Regionally, the most programs are found in the South (978), followed by the West (744). View a complete list of state-by-state program data.

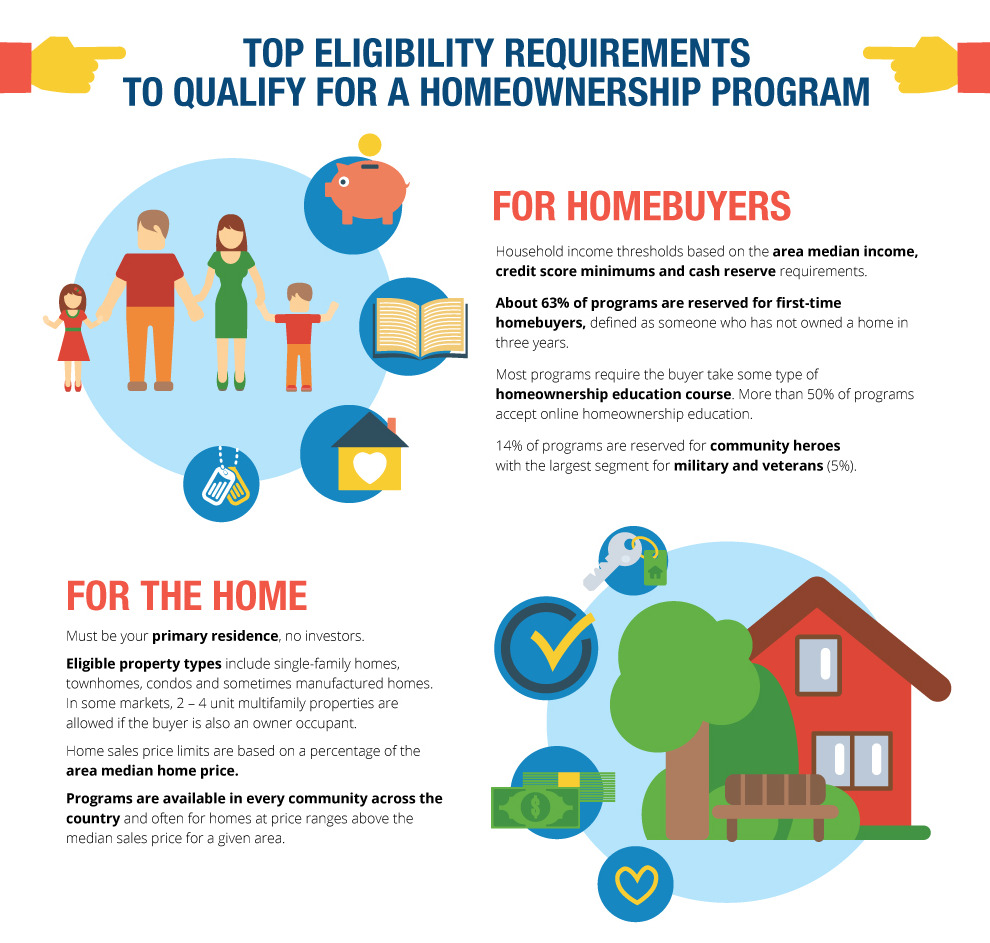

To qualify for a homeownership program, both the buyer and the property must meet certain criteria, which vary by program.

Top eligibility requirements for homebuyers include:

Top eligibility requirements for the home include:

Program information is constantly changing. In order to ensure information is current for real estate professionals and homebuyers, Down Payment Resource researchers verify and update program data monthly. More than 1,180 programs were edited since the prior update. Updates may include eligibility guidelines, benefits, program name, funding status and/or coverage area.

Download the full infographic.