What Lenders Are Getting Wrong About Down Payment Assistance

In a quarter where home prices year-over-year (YoY) jumped 6%, our Q1 2024 Homeownership Program Index (HPI) Report highlights the homebuyer assistance programs available to help make homeownership more accessible. Derived from our comprehensive DOWN PAYMENT RESOURCE® database, the report highlights the latest trends in down payment assistance (DPA) programs.

Our Q1 2024 edition reveals an increase in the availability and diversity of DPA programs, including an increase in programs supporting the purchase of manufactured and multifamily homes.

Seventy-nine homebuyer assistance programs were added in Q1, for a total of 2,373 programs. That’s 204 more programs than a year ago, an increase of 9% — the largest annual jump since DPR began reporting on this data in Q3 2020. Along with the increase in programs came an increase in agencies supporting them, which grew from 1,238 last quarter to 1,273 in Q1 2024.

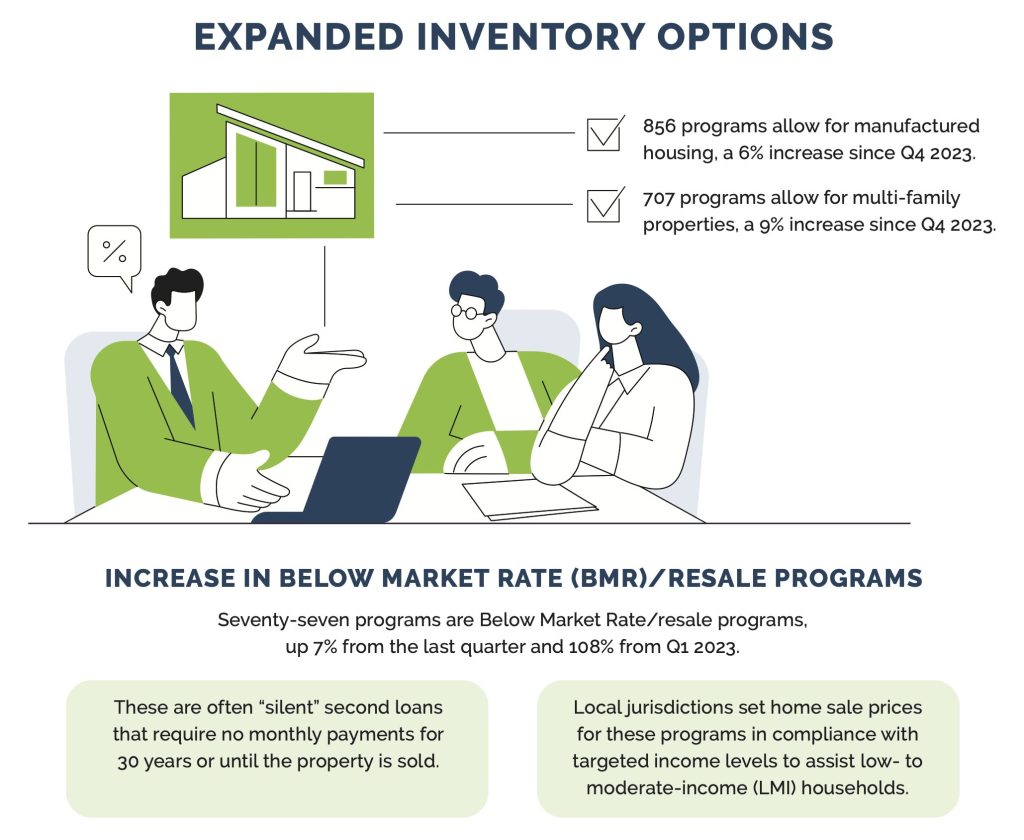

We also found upticks in programs supporting the purchase of affordable housing, including manufactured and multi-family housing. 856 programs are now available for manufactured housing, up from 703 last year, a 22% YoY increase. In Q1 2023, 647 programs allowed for purchase of a multi-family property. That number in Q1 2024 is 707, an increase of 9% YoY.

While 2,156 programs have income limits, the percentage that didn’t grew 11% from the previous quarter and 24% YoY. The report also revealed the evolving dynamics of Below Market Rate/resale programs, from 37 in Q1 2023 to 77 in Q1 2024, a 108% YoY increase.

The number of programs offered in Q1 2024 increased by 79 over the previous quarter, raising the total number of programs to 2,373.

Program Spotlight: The City of Tucson/Pima County HOME Down Payment Assistance Program offers buyers of manufactured homes a minimum DPA of $1,000 and a maximum of up to 20% of the purchase price. Buyers must have incomes at or below 80% of the HUD Area Median Income (AMI). Home prices are also capped at $302,100 for existing homes and $358,835 for newly constructed homes.

Program Spotlight: The NeighborWorks Southern Colorado Down Payment Assistance Program offers up to 10% of the purchase price to buyers of multi-family properties. The funds may be combined with other NWSOCO DPA programs, such as the NWSOCO State Funding DOLA program. The program is open to any buyers (not just first-time homebuyers) who have incomes at or below 100% of the HUD AMI.

Program Spotlight: The City of Novato Below Market Rate (BMR) Homeownership Program is open to buyers with incomes up to 120% of the HUD AMI. Buyers can use conventional or FHA financing. The home is sold below the market rate with a lien (second mortgage) in place to cover the difference between market value and BMR price.

192 programs are “incentive” programs, meaning they target a segment of homebuyers by profession or ethnicity. In Q1 2024, there was a 13% increase in programs YoY for Native American homebuyers. In comparison to white households in states with federally recognized reservations, Native American borrowers have lower incomes and credit scores. DPA can make a significant difference in helping lenders qualify these homebuyers.

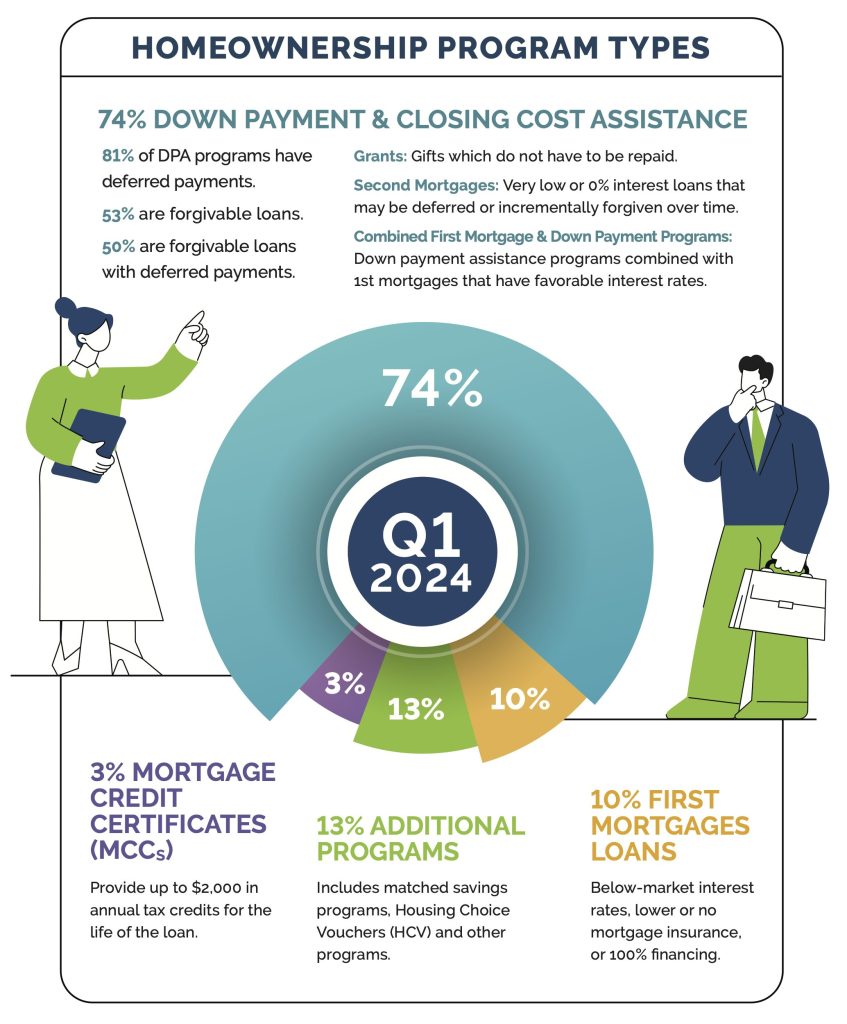

Here is a breakdown of the homebuyer assistance programs added since Q4 2023 by assistance type:

Overall, the breakdown of homebuyer assistance programs available by type was virtually the same as the previous quarter.

A complete, state-by-state list of homebuyer assistance programs can be viewed here. You can also download the full infographic.

Down Payment Resource builds tools that help mortgage lenders, real estate agents, multiple listing services and consumer listing sites build relationships with homebuyers by connecting them with the homebuyer assistance they need.

To learn how Down Payment Resource can help you support homebuyers, contact us.

Methodology

Published quarterly, DPR’s HPI surveys the funding status, eligibility rules and benefits of U.S. homebuyer assistance programs administered by state and local housing finance agencies, municipalities, nonprofits and other housing organizations. DPR communicates with over 1,300 program providers throughout the year to track and update the country’s wide range of homeownership programs, including down payment and closing cost programs, Mortgage Credit Certificates (MCCs) and affordable first mortgages, in the DOWN PAYMENT RESOURCE® database.