4 Common Down Payment Program Myths Debunked

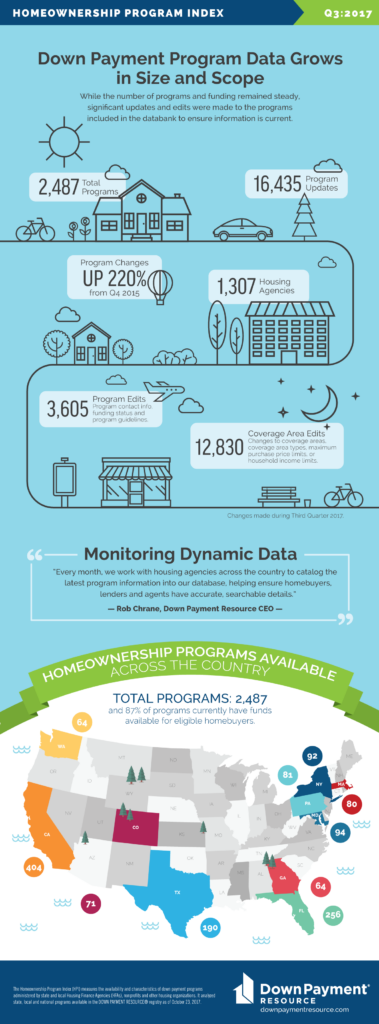

Down Payment Resource communicates with more than 1,300 housing agencies each month to make updates to homeownership programs. While the total number of programs and funding availability remained steady, this quarter the company made 16,435 total program edits, including important eligibility requirements, program guidelines and funding status.

The total programs increased to 2,487, up 18 programs from the previous quarter. More than 87 percent (87.1%) of programs currently have funds available for eligible homebuyers, up slightly from the previous quarter.

“We’re proud to be the first company to develop a nationwide database of down payment programs, but it’s an even greater achievement to keep those details up-to-date. Every month, we work with housing agencies across the country to catalog the latest program information into our database, helping ensure homebuyers, lenders and agents have accurate, searchable details,” said Rob Chrane, Down Payment Resource CEO.

Homeownership programs are available across the country, designed to meet the housing needs for a buyer segment or community. For every program, Down Payment Resource monitors changes to many dozens of data points, income and coverage area tables, program benefits, and funding status. This quarter’s Homeownership Program Index reviewed the volume of program changes made from July 1 through September 30.

Homeownership programs are available across the country, designed to meet the housing needs for a buyer segment or community. For every program, Down Payment Resource monitors changes to many dozens of data points, income and coverage area tables, program benefits, and funding status. This quarter’s Homeownership Program Index reviewed the volume of program changes made from July 1 through September 30.

Program changes are up 220 percent from Q4 2015, when the HPI last reviewed total program changes. The increase in program update activity is attributed to the addition of more data points per program as well an increase in the total programs being monitored.

“We continually review our technology, seek feedback from our customers and users, and look for opportunities to enhance our data. The more specificity we can provide, the easier it is for homebuyers to explore all of the options available to them as they plan for homeownership,” said Sean Moss, Senior Vice President of Operations for Down Payment Resource. “Likewise, lenders can better understand the options available to their originators to tap into new buyer segments and help them solve for their biggest obstacle to homeownership. And, real estate agents can pinpoint opportunities available in their market and comfortably promote those programs to new buyers.”

Many events can impact homeownership program guidelines, including funding source and master servicing requirements. For example, when HUD makes its annual Area Median Income (AMI) limits for all of the more than 3,000 counties across the U.S., many program administrators also update their own programs’ income limits.

In addition, any given program can change on short notice, and multiple times per year. Because those changes aren’t predictable, Down Payment Resource constantly monitors and works with program administrators to keep the program information up-to-date.