Homeownership May Be Closer Than You Think

Our Second Quarter 2017 Homeownership Program Index highlights the latest trends across all down payment programs, plus growth in shared equity program models as homeownership affordability challenges persist for millennial buyers.

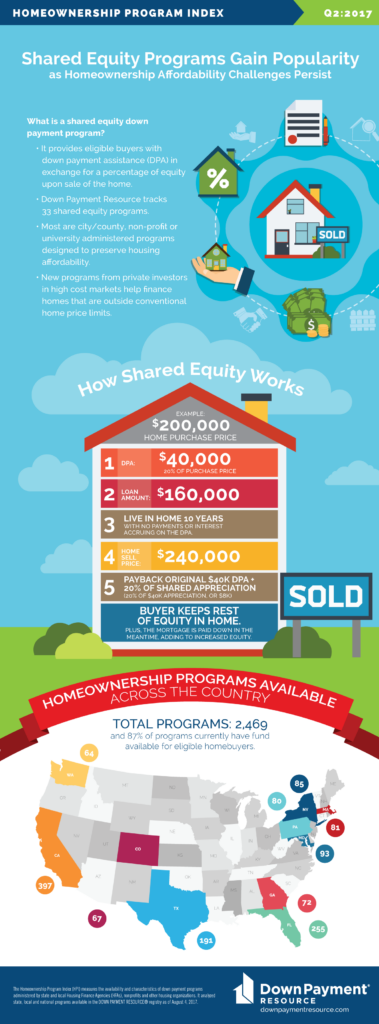

The number of total programs increased to 2,469, up 15 programs from the previous quarter. Nearly 87 percent (86.8%) of programs currently have funds available for eligible homebuyers, roughly unchanged from the previous quarter. New programs in the database include shared equity programs that provide a portion of the down payment in exchange for a percentage of equity upon sale of the home.

The Down Payment Resource HPI currently tracks 33 shared equity programs. Most are city/county, non-profit or university administered programs. There are also new programs in high cost markets, like the San Francisco Bay area, designed by private investors to help buyers finance homes that are outside conventional home price limits.

“Municipal shared equity programs have been around for a long time, and today we are seeing more private investors enter the market,” said Rob Chrane, CEO of Down Payment Resource. “Because this home financing model trades some of the long-term homeownership value, it will be important for buyers to first carefully evaluate all their down payment program options.”

The Urban Institute evaluated shared equity programs and found they are successful in linking low- and moderate-income people with affordable owner-occupied housing. In addition, homeownership among shared equity programs is sustainable, and shared equity homeowners resell their homes with the same frequency and for the same reasons as other homeowners.

Shared equity programs are an alternative to traditional down payment assistance funding for municipal or non-profit providers. The buyer receives funds for part of the down payment in exchange for a share of the equity gained. In most cases, the buyer must also pay back the initial down payment investment at resell.

Shared equity programs are an alternative to traditional down payment assistance funding for municipal or non-profit providers. The buyer receives funds for part of the down payment in exchange for a share of the equity gained. In most cases, the buyer must also pay back the initial down payment investment at resell.

These programs are often designed to keep the home prices affordable for the next buyer and continuously re-fund the program. Benefits to the buyer include helping lower their first mortgage, thereby reducing their monthly payments and accruing more equity from paying down the mortgage faster. The following are examples of such programs:

In recent years, more private market shared equity programs have entered the market. These programs often don’t have income or home sales price eligibility requirements, but they do have minimum and maximum investments.

Unison offers a shared equity down payment program for homebuyers in 12 states and Washington D.C. It provides half of the buyer’s down payment funds in exchange for a share—typically 35 percent—of the change in value of the home upon sale. Unison’s funding comes from institutional investors, including pension funds and university endowments.

Download the full Second Quarter 2017 Homeownership Program Index press release.