What Lenders Are Getting Wrong About Down Payment Assistance

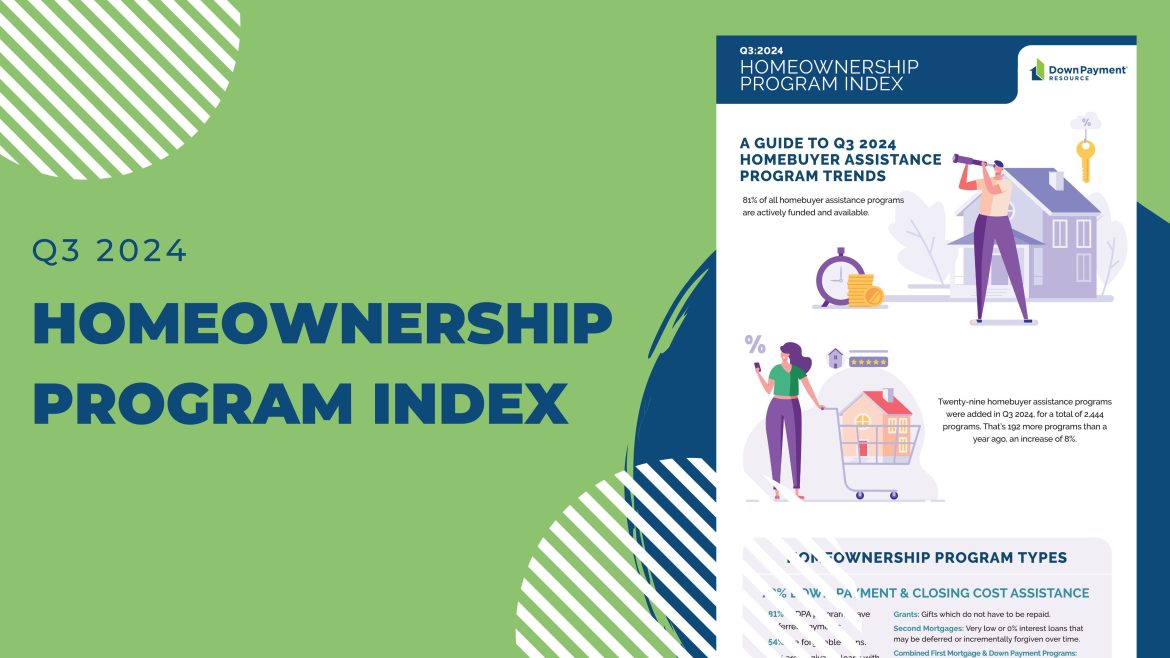

DPR’s Q3 2024 Homeownership Program Index (HPI) Report, which highlights the homebuyer assistance programs available each quarter to help make homeownership more accessible, has revealed some exciting findings. First, we’ve set yet another record for the number of nationwide programs with all 2,444 currently being tracked by DPR. Plus, we’ve noted an uptick in the number of programs allowing for the purchase of multifamily and manufactured housing, which helps lenders widen their inventory box.

Derived from our comprehensive DOWN PAYMENT RESOURCE® database, the HPI report highlights the latest trends in down payment assistance (DPA) programs.

Twenty-nine homebuyer assistance programs were added in Q3, for a total of 2,444 programs. That’s 192 more programs than a year ago, when we counted 2,256, an increase of 8%.

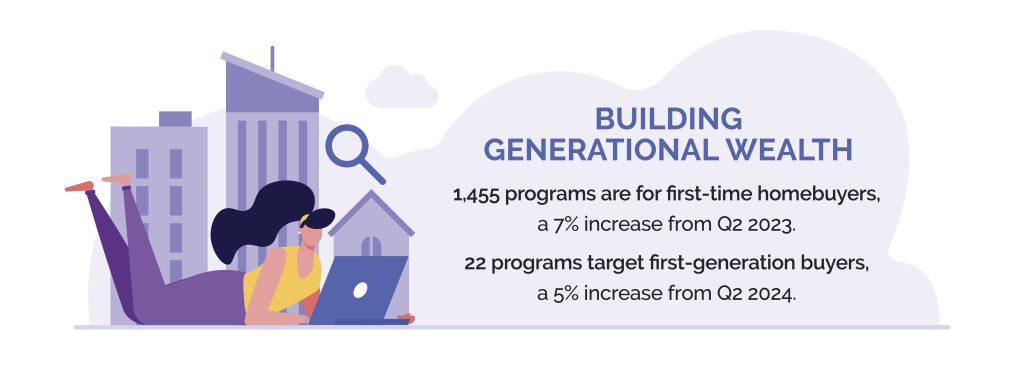

Our Q3 2024 edition of the report reveals a further increase in the availability and diversity of DPA programs, including a new breakdown of the programs that allow for the purchase of multifamily properties. Of those, we found that 777 allow for two-unit properties, 526 allow for three-unit properties, and 501 allow for four-unit properties.

While 2,218 programs have income limits, 226 do not, a 20% increase from a year ago. This latitude may make it easier for lenders to qualify at moderate income levels who need assistance with their down payment, closing costs, or other costs of homeownership.

The number of programs offered in Q3 2024 increased by 29 over the previous quarter, raising the total number of programs to 2,444 from 2,415.

Program spotlight: Riverside County American Rescue Plan Act (ARPA) First Time Home Buyer (FTHB) Program offers homebuyers a 15-year, 0% interest, deferred forgivable loan for 20% of the purchase price up to $100,000 (whichever is less). The program’s maximum home purchase price is $536,750 and income can be up to 120% the area median income (HUD limits).

Program spotlight: The Champlain Housing Trust Manufactured Home Down Payment Loan program offers a $40,000, 0% deferred, forgivable loan with no sales price limits. The program is open to first-time and repeat buyers; however, income is limited to 120% of the HUD AMI limits.

Program spotlight: Minnesota Housing Finance Agency’s First-Generation Homebuyer Loan offers homebuyers up to $35,000 in the form of a 20-year, 0% deferred, forgivable loan. Half of the loan is forgiven at 10-years and the rest after 20. Purchase price limits range from $498,257 to $659,550 and income limits range from $111,800 to $142,800.

Program spotlight: The City of Haverhill’s First Time Homebuyer Downpayment Assistance Program offers up to $15,000 as a 5-year, 0% deferred, loan that’s forgivable at 20% per year. Purchase price limits range from $498,000 to $939,000 and income limits range from $68,500 to $129,100.

Here is a breakdown of the homebuyer assistance programs added since Q2 2024 by assistance type:

Overall, the breakdown of homebuyer assistance programs available by type was virtually the same as the previous quarter.

A complete, state-by-state list of homebuyer assistance programs can be viewed here. You can also download the full infographic.

Down Payment Resource builds tools that help mortgage lenders, real estate agents, multiple listing services and consumer listing sites build relationships with homebuyers by connecting them with the homebuyer assistance they need.

To learn how Down Payment Resource can help you support homebuyers, contact us.

Methodology

Published quarterly, DPR’s HPI surveys the funding status, eligibility rules and benefits of U.S. homebuyer assistance programs administered by state and local housing finance agencies, municipalities, nonprofits and other housing organizations. DPR communicates with over 1,300 program providers throughout the year to track and update the country’s wide range of homeownership programs, including down payment and closing cost programs, Mortgage Credit Certificates (MCCs) and affordable first mortgages, in the DOWN PAYMENT RESOURCE® database.